AGP Support: Competitor Benchmarking, Due Diligence

Industry: Industrial Automation, Private Equity, Technology & Software

Valuation Benchmarking

Client

An industrial SaaS company that provides software solutions for factory operations, focused on monitoring and analytics.

Situation

The client wanted to better understand their company’s valuation range to communicate effectively with investors. They needed a benchmark of comparable pre-A and A round transactions in the factory operations monitoring and analytics SaaS markets to inform their discussions with potential investors.

Approach

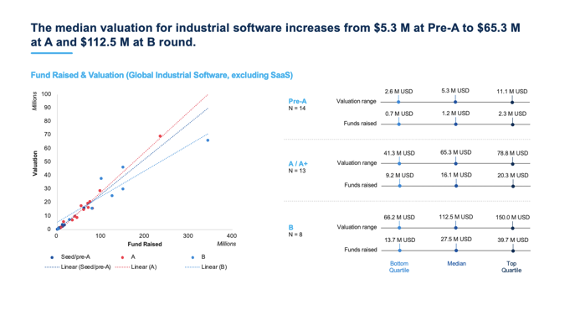

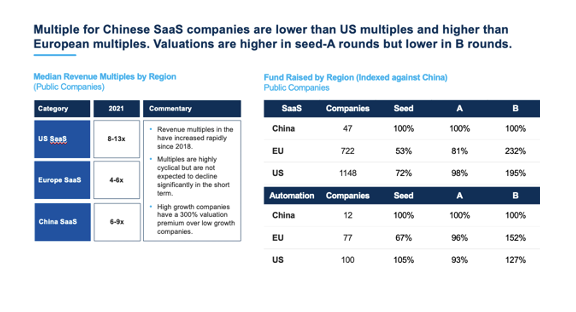

Asia Growth Partners worked closely with the client’s chairman to benchmark over 120 comparable transactions and 60 publicly listed companies.

- Collecte data on revenue multiples, total funding raised, and valuation metrics specific to the SaaS market.

- Identify bottom, median, and top valuation quartiles to establish a clear valuation range.

- Define qualitative investment criteria for future investor conversations.