How to extract value from your data

What defines the most financially successful companies? In 2010, this was a difficult question to answer. The ten most valuable companies in the world were distributed across energy, finance, pharma, retail, and digital technology and had a market cap of $2.3 trillion. By 2020, seven of the ten most valuable companies were in digital technology and the combined market cap grew to $13.7 trillion. Software is eating the world.

These companies are creating new markets and winning legacy markets with their ability to leverage data to achieve multiple outcomes simultaneously. They create value in new ways for customers while generating operational efficiencies that strengthen their bottom line. Data-enabled organizations act nimbly and can adapt to shifting circumstances.

Many companies have swathes of data but struggle to put them to practical use. In order to realize value from their data, companies need to rethink the business models of their core businesses and seek opportunities to generate new revenue streams. Analysis of product and service usage data can provide a better understanding of who customers are, their needs and challenges, and their product usage behavior. This input can support improvement of existing products, development of new offerings, and streamlining of marketing and sales approaches through better targeting.

A rigorous investigation of the potential for value creation will often lead to a reassessment of priorities. Important questions to ask include:

- What data do we have consistent access to? Are there restrictions on our ability to use this data due to privacy, ownership, or other considerations?

- Where in our organization do we lack operational transparency?

- Where can processes be automated or streamlined with the right data inputs?

- How could our data enable us to better serve our customers?

- How could our data enable us to better understand our customers and segment them?

- Where could our customers, suppliers, distributors, 'whole product' partners, and other external stakeholders derive value from our data?

It is also useful to assess where your organization is relatively strong or weak across the data value chain: data generation and acquisition, data processing, data integration and curation, and data exploitation and visualization. For example, many companies with physical products are strong in data generation but weak in processing and integration. They often have significant opportunities for data exploitation due to their domain expertise and understanding of customer needs, but may lack the technical knowhow to build quality applications.

.jpg)

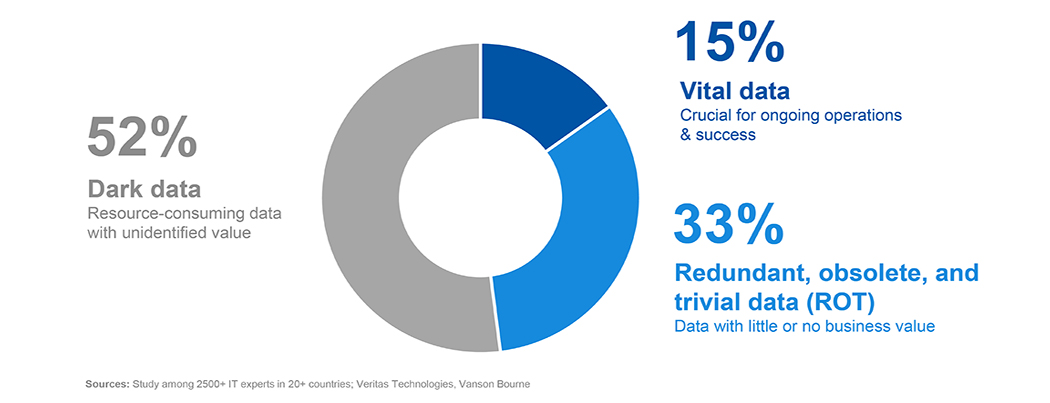

How to separate data diamonds from coal?

Planning begins with mapping the realized and potential value of data. Today, an estimated 85% of data is considered useless because it is poorly managed. An estimated one-third of data is truly useless, since it is redundant, obsolete, or trivial (ROT). However, the majority of data simply has an unidentified value. This presents a massive windfall for organizations that can identify where the value lies in that data and repurpose it in non-traditional ways – essentially resulting in found value from existing assets.

A guiding principle to this is undergirded on the uniqueness/value/risk axis. The more unique a particular set of data is, the more value/risk it has. The best way to address this is to look for the missing pieces in your data story, identify the goals you hope your data will help you achieve, and find ways to fill those holes either internally or externally. A common mistake many companies make is that they do not attempt to identify what they don’t know about their consumers, but rather merely focus on what they do. If you identify what you want to know about your customers, but don’t, then you can map that onto the relevant data sets you already possess to generate that type of insights you’re looking for. With these holes in mind, you’ll be able to adjust your data collection strategies to refine your data sets while also demonstrating the holes you have in your data collection strategies that may be able to be outsourced to third parties.

The next step is identifying if you possess the internal resources to accomplish the requisite data analysis. This is often difficult as it requires honest self-reflection on organizational weaknesses. The mismanagement of data analytics can also be a costly and time-consuming process. It is always best to build a high degree of confidence in your data sets by outsourcing data analytics when appropriate, and importing data sets when needed to plug holes in internal databases.

What is a data-driven business model?

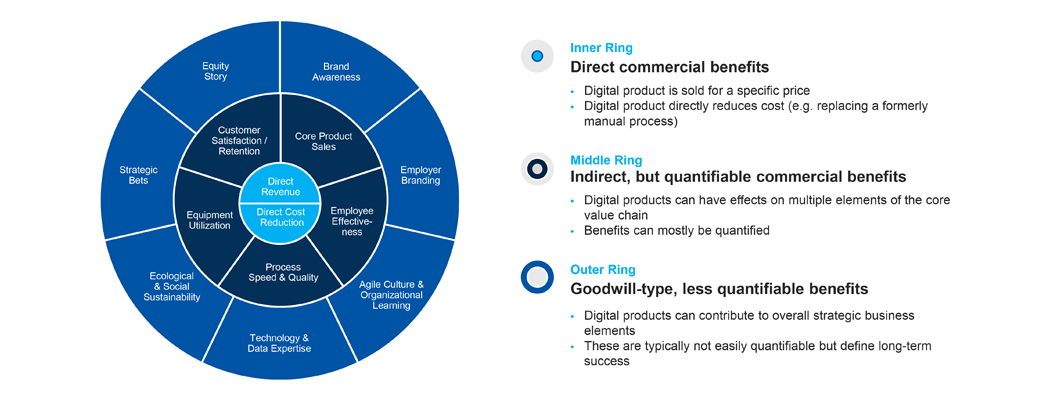

When you say data, what exactly are you talking about? To many in the business, a data-driven model consists of 1st order effects; however, what a lot of businesses fail to take into consideration and implement is the 2nd and 3rd order medium to long-term effects. Short-sighted operators may only think in terms of direct revenue and direct cost reduction, whereas smart data analytics can have indirect, but quantifiable commercial benefits like equipment utilization, customer retention, and employee effectiveness. Third-order effects have less quantifiable benefits but still can help to make strategic bets, track ecological and social sustainability, and track brand awareness. Many of these concepts may seem abstract because they are difficult to measure, but they are the foundation of a successful business.

A company’s portfolio of digital solutions should also be assessed to ensure that investments are aligned with organizational priorities. Without vision into the overall digital portfolio, it is difficult to avoid over or under-investing in areas. The Digital Value Canvas shown below illustrates the three layers of value creation. Your current portfolio can be mapped against company priorities to identify areas of over or under-investment.

The value created through data-driven digital products and services should be fully understood and designed carefully. A simple four-step process is useful for exploring opportunities.

1. Ideation – Understand the Problem: is it a problem worth solving?

- Figure out the need in the market or internally (problem first!)

- Scope data required to solve the problem e.g., internally existing/generated or externally acquired.

2. Design – Generate Business Concepts: is there a solution?

- Ideate ideas (e.g., Design Thinking approach)

- Define business model components, estimate value

- Define key data activities: data generation, processing, analytics

3. Validation – Prototype & Test: delivering on promises.

- Develop MVP (minimum viable product), including actual access to data

- Analyze data and visualize/leverage insights

- Constantly iterate with customers and users

4. Market Entry – Implementation: how to scale it.

- Build go-to-market and deliver revenues/margins

- Iterate on the business model

- Add functionality to MVP (minimum viable product)

- Draw learnings and repeat with additional IoT business models

A common timeline for rolling this exercise out in a business unit is 3 - 8 months depending on the complexity of the situation. A more detailed overview of the 22 steps is provided below.

Ideation: 1 – 3 weeks | Design: 2 – 4 weeks |

1. Map disruptions and trends Cross-functional team 2. Identify threats to existing business Cross-functional team 3. Identify opportunities for new business Cross-functional team 4. Sketch threats and opportunities Cross-functional team 5. Define value drivers and success levers Core team 6. Rank and prioritize opportunities Core team / Steering committee | 7. Create product storyboards Core team 8. Map solution technology stack Core team + technology experts 9. Analyze stakeholder networks Core team + business experts 10. Decide “build-buy-partner” Core team + technology & business experts 11. Build IoT business model canvas Core team 12. Complete business case Core team + controlling experts |

Validation: 4 – 8 weeks | Market Entry: 8 – 16 weeks |

13. Identify challenges Core team + functional experts 14. Define key hypotheses to validate Core team 15. Implement validation plans Core team 16. Plan Business model scenario Core team + controlling & planning experts | 17. Choose a medium of entry Core team + business experts 18. Define prospecting strategy Core team + business experts 19. Test the market with MVP Core team + business experts 20. Monitor actual business case Core team 21. Iterate the product Core team 22. Draw learnings Core team + cross-functional team |

Case studies

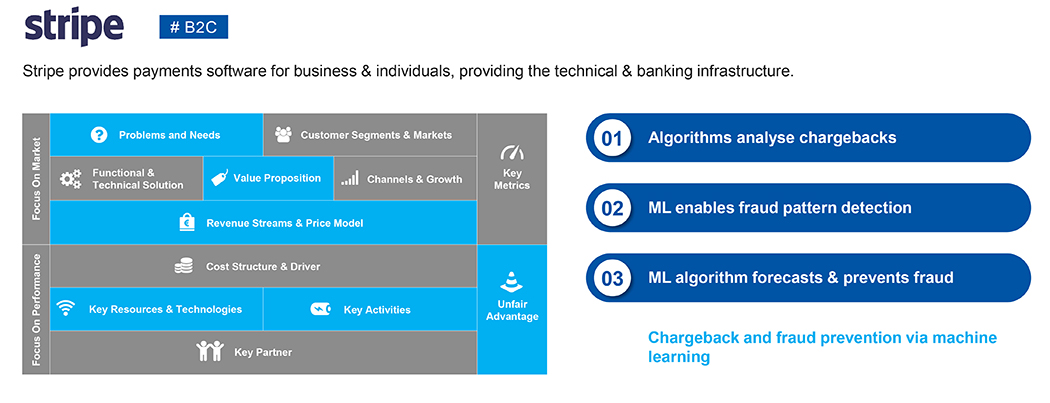

Data is a particularly useful way of identifying problems and solutions. It might not always be the solution itself, but it can provide insight into possible directions. Let’s look at some examples of three organizations that have used data to identify problems and plot solutions.

1. Amazon

.jpg)

2. Stripe

.jpg)

3. Schindler

Asia POV

The Internet of Things market in the Asia Pacific region is expected to expand at a compound growth rate (CAGR) of 29% and reach $424 billion by 2025. Asia is already a major IoT market due to its position as the largest manufacturing hub in the world. Governments in many Asian nations are also promoting digital currencies, high-speed networking technology, and other infrastructure that will support value creation from data. For example, Seoul deploys 1,000 LoRaWAN gateways to enhance Wi-Fi capacity in the city to power its smart city initiative. And Chinese cities are adding 5G towers at a rapid pace. The pandemic has further accelerated the adoption of IoT devices in Asia to navigate supply chain disruptions. According to the latest Microsoft IoT Signals report, Asia is leading the world in both growth and growth potential, two important metrics.

China is emerging as a global leader in the development and adoption of digital business models, led by Alibaba, JD, Dianping, Didi, and others. These companies have invested heavily in cross-platform data partnerships in order to leverage their data sets and expertise in new industries. For example, Didi uses its understanding of traffic patterns to support autonomous car research and to predict bottlenecks for food delivery services like Eleme. The Asian ecosystem is ripe with opportunities for companies ready to build the next generation of data-enabled business models.

Related Insights.