How to build your digital innovation footprint in Asia

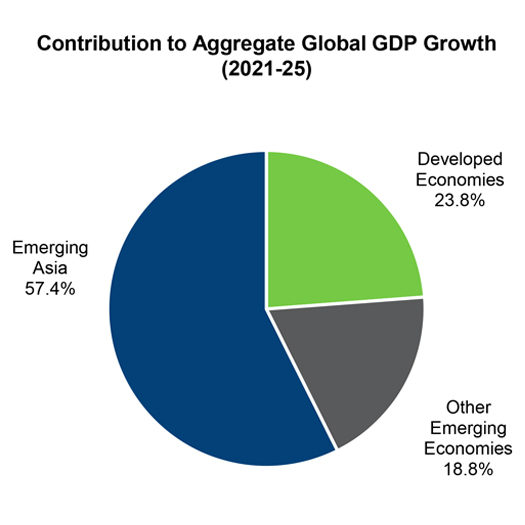

One of the most significant stories of this century will be the resurgence of Asia as the largest global economic hub. Asia was the dominant region economically well into modern history, with over 60% of global GDP in 1800. After slumbering for two centuries, Asia today contributes 40% of global GDP and its share is steadily rising.

The IMF expects Asia to contribute 57% of global GDP growth in the medium term, generating $10.1 trillion in new annual economic activity by 2025. China alone will contribute 31% of global GDP growth during this period, or $5.5 trillion. Yet Asia is a complex region. Its population is digital savvy yet socially traditional. And its markets range from the sophisticated urban centers of Tokyo and Singapore to the world’s busiest manufacturing hubs to vast agrarian communities. Building a successful business in Asia requires focus, agility, and innovation. |

|

B2B technology companies that seek market leadership must be competitive in Asia. China has the world’s largest supply chain footprint today, while emerging markets like India, Vietnam, and Indonesia present are rapidly developing their infrastructure. Successfully competing in Asia requires confronting the key differences between Asian and Western markets. Let’s explore them.

How Asian markets differ from Western markets

China is the dominant player in Asia’s industrial and digital domains, and it exemplifies the VUCA dynamics that are apparent throughout Asia. VUCA represents four key concepts: volatility, uncertainty, complexity, and ambiguity. It is pervasive in markets that are fast growing, dynamically evolving, and subject to complex regulatory and socio-economic environments. Welcome to emerging Asia.

.jpg)

From a competitive standpoint, Asian markets can be both fierce and blue ocean. Their fierceness derives from the hunger and tenacity of local entrepreneurs. But in many categories, Western technology companies have a multi-year head start in core IP that is simplify difficult to emulate. ‘Hard tech’ companies often find large markets that value technical leadership. For example, the region has long been the profit driver for Germany’s industrial conglomerates and hidden champions.

It is important to note how successful technology companies navigate Asian ecosystems. Successful B2B companies typically do not have to modify their core technologies – technical solutions tend to translate well. But they do adapt their service models, feature sets, integrations, business models, value propositions, and sales approaches to meet local market requirements. In short, they focus on localizing business innovation rather than R&D.

Adaptation is necessary across strategy, organization, and execution. What emerging markets will you prioritize? What capabilities do you require to win these markets? And how will you empower the team to realize their goals? These questions must be answered, and then answered again and again as the market evolves.

Like many foreigners living in Shanghai, I often have the sense of traveling through a time warp when I visit the US. One year of “Shanghai time” seems to fit in five years of change in a typical American city. As a result, decision making and execution must be pushed to the local team. If a headquarters-based manager or engineer becomes a bottleneck in the way of a needed change, it will be very difficult to sustain the speed required to be competitive.

Innovation portfolios need to be strictly managed along a transparent and logical innovation funnel. Otherwise, typical innovation funnel problems will bind resources and cause tremendous yield losses for the innovation department. Common challenges that multinationals face in localizing their innovation efforts in Asia include a lack of local insight by decision makers at headquarters, difficulty validating problem-solution fit before proceeding with investments, long and expensive development cycles driven by global ‘centers of excellence’, and the inability to rapidly scale initiatives up or down in order to adapt to market signals.

.jpg)

There are a small set of golden rules to keep in mind when adapting innovative strategies to local conditions:

- The customer is always right, headquarters is not. Listen to the needs of your customers and adapt your portfolio, business model, and pricing to meet their expectations.

- Empower local teams to identify market needs, set growth priorities, and make the changes needed to deliver the right offering at the right price.

- Invest in training teams and providing growth opportunities to develop local capabilities and retain talent.

- Leverage the ecosystem. Your local teams will have more narrow domain expertise than headquarters. The local ecosystem can fill capability gaps and enable speed and agility.

Threats and Opportunities

Any change in the technology landscape can present both threats and opportunities to a business. The perspective depends entirely on a company’s ability to identify, understand, and appropriately react to trend before their competitors. Digital trends can be divided into three categories enablers, architectures, and disruptors.

Enablers are mature technologies that define the current ecosystem. As they experience gradual improvement in cost and performance, they enable new use cases and business model. Sensors and cloud computing are a good example of an enabling technology. Architecture trends relate how technologies are combined with business models to provide value in new ways. Platform business models are an example of a relatively new architecture that has been successful in Asia. Finally, disruptors are emerging technologies that will enable entirely new ways of providing value. Today’s disruptors will become tomorrow’s enablers. 5G is an example of a modern disruptor that has not yet transformed markets but is expected to over the coming decade.

The innovation efforts of multinational companies in Asia will typically be oriented around enablers and architectures. Most companies prefer to explore the value of disruptive innovations in their home markets first. But incremental improvement in enablers can provide differentiation from local competitors. And architectural changes in an offering are often needed to order to meet the expectations of different market segments. For example, Alibaba Cloud partners successfully with industrial technologies companies through an N+1 model to combine Alibaba’s market access with the domain expertise of partners.

Exploring ideas that could present a threat or an opportunity for your business should be approached in a structured funnel. An ideation funnel is designed to evaluate ideas in stages. Each stage uses the minimal required resources to assess importance. The ideas with the highest potential to impact a business pass to the next stage, while the majority of ideas should be paused early and returned to the backlog for future iteration.

For example, the qualification stage answers the question “what would this idea look like in practice, and how could it impact our business?” Qualification can be accomplished over the course of one or two weeks and a few internal workshops. Many ideas will be paused at this stage. The validation stage then requires a larger resource commitment to assess how customers, channel partners and other key stakeholders perceive the idea. After validation, the idea should be refined and there should be a strong indication of potential market acceptance. This may require one to three months. If an idea passes validation, an MVP can then be developed to generate higher resolution feedback. It is this stage that tends to require significant investment, therefore only the most promising ideas should proceed to the MVP stage.

A diverse range of marketing, business strategy, and technical competencies are required to convert an idea from an initial concept into a market-ready offering. Companies will generally be faster, more cost effective, and more accurate in their priorities if they localize these competencies. However, since local market resources are often limited, localization often requires adopting an open innovation model in which colleagues from business units and external partners are leveraged at different stages of the process.

.jpg)

Digital Innovation Trends in Asia

It can be useful to survey the landscape of local technology leaders to understand what trends they are exploring in the market. Although these trends are only snapshots, they provide insight into emerging opportunities.

1. Virtualization of Services

The pandemic has forced much of Asia to adopt work-from-home models. This has accelerated the development of online services across multiple sectors. In the health care and education sectors, platforms like DingTalk are converging online and offline services to increase access.

In China, where tier-one cities have 3 times the per capita education budget of smaller tier-three cities, we are seeing the creation of an equal playing field via digital services. A recent survey conducted by Aixuexi showed that 68% of parents favored O2O (online to offline) education. The development of AI and 5G will allow for personalized services based on individual pattern recognition and environmental considerations to drive market factors.

In the real estate sector, the traditionally offline experience of viewing properties has quickly shifted online. Beike, an integrated O2O platform for property transactions and services, grew the volume of its VR property visits 35 times during the pandemic. The virtualization of services is set to bleed into other sectors.

Digitalization will reduce the need for face-to-face interactions, break financial and physical barriers, and democratize quality of service.

2. Digitalization of Social Life

The buzzword of the day is ‘metaverse’. Virtual worlds depicted in cyberpunk novels like Neuromancer are on the verge of becoming reality. The pandemic has drastically altered societal norms - especially in Asian societies like Japan that are already ahead of the curve in digitalization. Social interactions, leisure activities, marketing, entertainment, and engagement more broadly will shift into virtual realms.

The development of virtual social spaces will also play a vital role in formulating business strategies that leverage online spaces to enable social activities and commerce in developing areas where physical infrastructure is limited and cannot accommodate demand.

For example, steaming sites like Huya and DouYu have cultivated online communities around live streaming hosts, popular games, and niche subcultures. Their communities organize real-world events like running clubs and dinner parties that blend physical and digital spaces to create opportunities for community leaders and organizers to create a decentralized and creator-friendly ecosystem. Finding partner organizations to organize communities within will be a leading trend in the digitalization of social life on the metaverse.

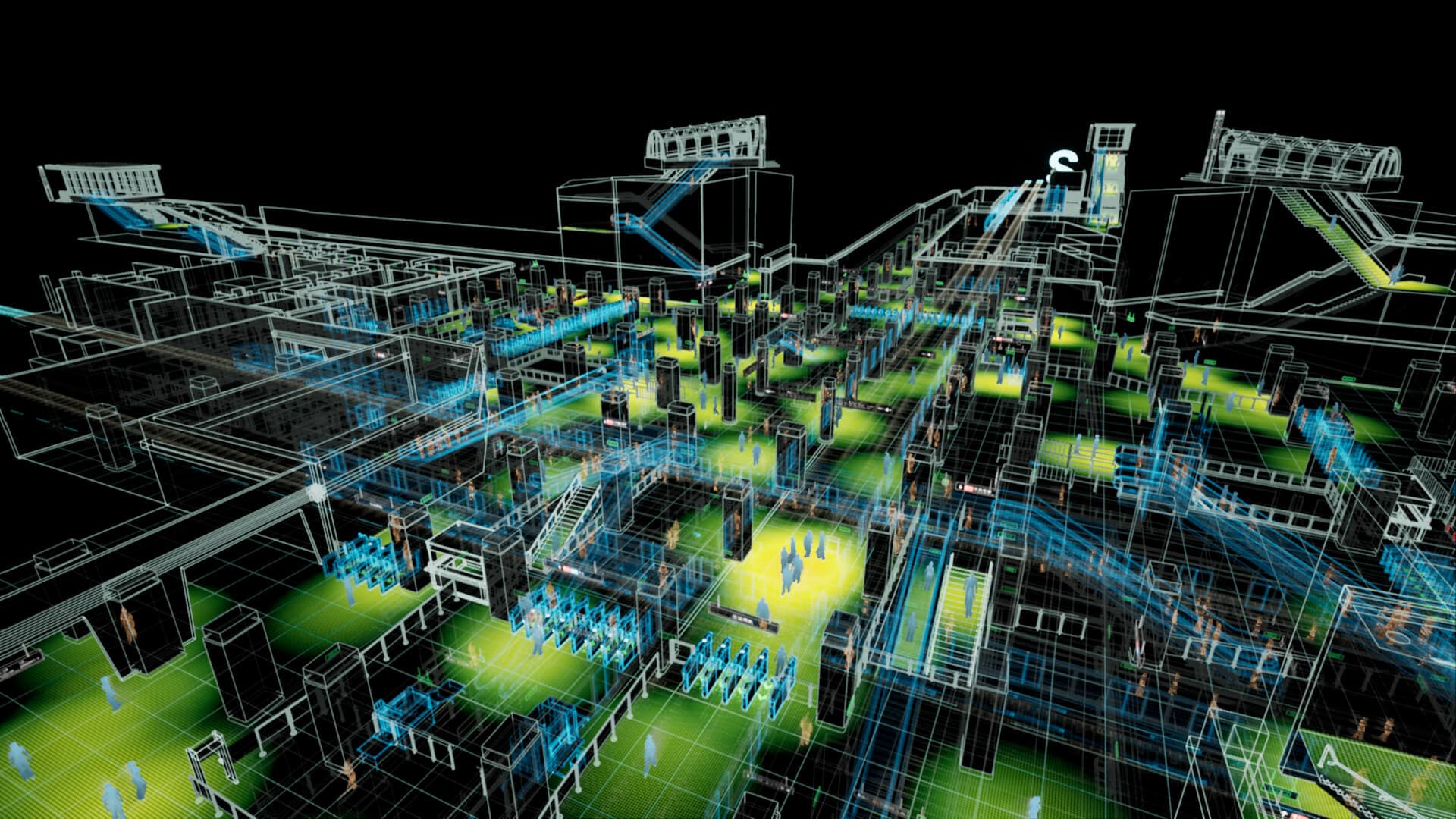

3. Supply Chain Digitalization

Essentially, digitalization turns analog supply chains into digital ones by aggregating information across an entire supply chain to form a master data set that regulates manufacturing, distribution, and innovation.

As IoT becomes deployed at scale, it will transform how businesses optimize their manufacturing footprints, from throughput to inventory management. Take for example Midea, a large Chinese white goods manufacturer. They have begun to roll out sensor-enabled “flexible automation” assembly lines that are fully automated and can adjust for different product models on the fly, even switching between materials. These systems enable Midea to efficiently produce a wider range of product configurations which allows them to bring new models to market faster and to customize products for more narrow customer segments. This is about revenue growth, not cost savings.

Midea’s “flexible automation” system is part of a larger digital infrastructure that is fed data from product usage, which R&D teams can use to improve future generations of products. Connecting systems for better decision-making will be key to keeping up with market demand.

Where to Innovate in Asia

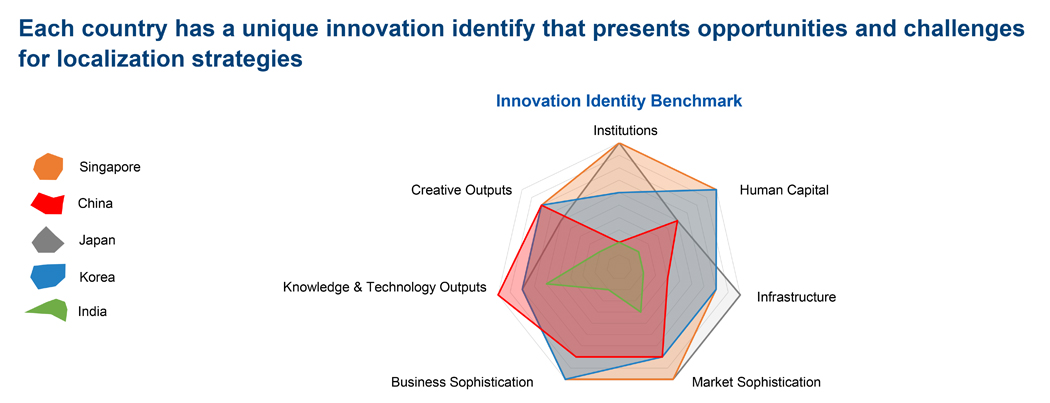

Asia is a diverse region with many strengths and weaknesses. Each country possesses unique supply chain capabilities, market dynamics, and innovation capacity. For example, China is the most advanced Asian country in terms of patent output, but institutional limitations present risks for intellectual property. As a result, companies often prefer to focus on business model and solution architecture innovation in China, rather than on core R&D. In contrast, Singapore’s western modelled institutions have attracted many regional R&D centers.

When considering where to develop your innovation footprint, we recommend considering proximity to customers and suppliers, the technical and industry expertise of local talent, open innovation ecosystems (startups, research centers, universities, venture capital), and the institutional environment. For example, India may be more attractive as a global R&D support center, while product innovation may be more important for growing in China.

.jpg)

Each country has unique innovation capabilities. Take a serious look at your needs and consider which location will best position you to achieve your innovation and business goals.

Related Insights.